-

Hvad er skattely?

Denne tekst er tidligere udgivet af OmFinans i 2017. Skattely er et komplekst fænomen, som har mange navne og mange definitioner. Skattely er det danske udtryk, “tax havens” er den direkte engelske pendant, men herudover anvendes også fx ”offshore centres”, ”secrecy jurisdictions” (hemmelighedsjurisdiktioner), eller ”usamarbejdsvillige lande”. Fælles for de mange betegnelser er en generel karakteristik…

-

Ain’t nothin’ but a G7 thang

This weekend, the Group of Seven (G7) finance ministers completed a “historic deal”, a new “global tax agreement” that will truly bring the international tax system “into the 21st century”. Or so, at least, is the narrative presented by some of the G7 folk (most prominently UK chancellor Rishi Sunak), which has been swallowed by…

-

The Paradise Papers should lead us towards a new global tax system

Last week, I published an op-ed in Danish newspaper Politiken with my colleague Saila Stausholm. I reproduce it below, liberally translated, for those interested. Given the op-ed format, it naturally has certain limitations and a certain style that differs from my usual writings on this blog – so take that into account. Here we go: The Paradise…

-

Varieties of Something

What is a tax haven really (if anything at all)? How can we classify them? And what are the existing attempts at doing so? In connection with a research project, I recently asked for your help in pointing out sources discussing different “varieties” of tax havens, i.e. what different countries “specialise” in. That fostered a series…

-

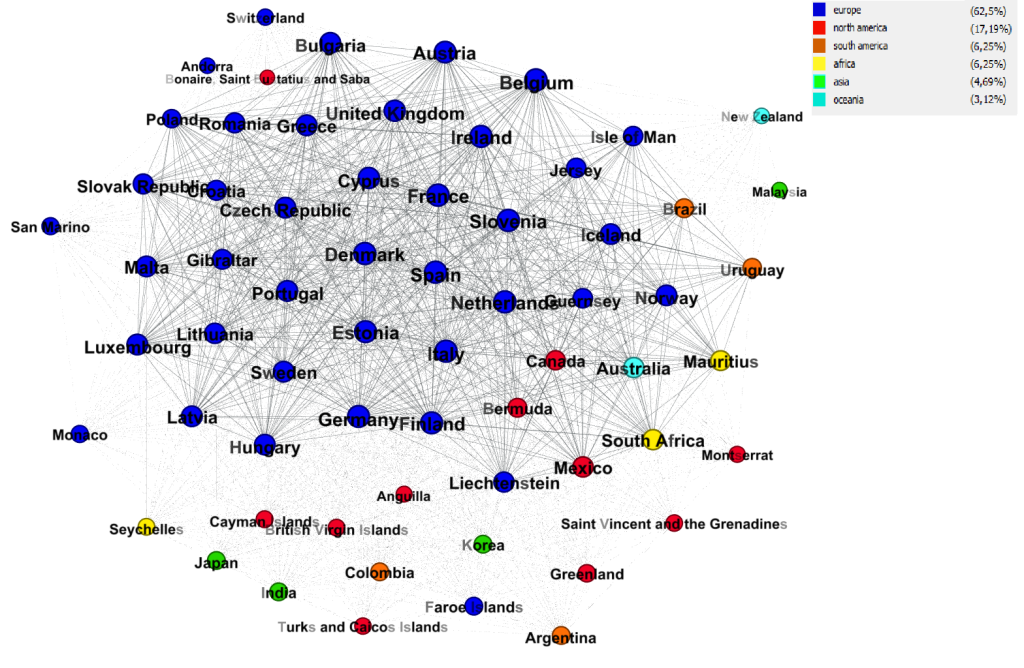

The new political economy and geography of global tax information exchange

The OECD has recently released information on the two most important recent global networks of global tax information exchange. They are, respectively, the networks of exchange of country-by-country reporting (CBCR) and exchange of financial account information (through the Common Reporting Standard, CRS). These networks give a unique look into the new political economy and geography of…

-

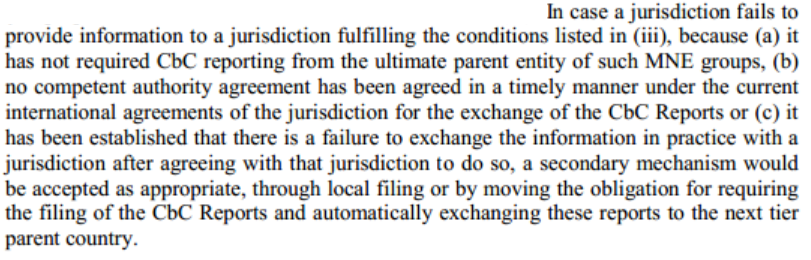

The quiet BEPS revolution: Moving away from the separate entity principle

For the longest time, international law has treated multinational enterprises (MNEs) as consisting of separate, independent units, rooted in separate national jurisdictions. Apple’s US corporate headquarters is distinct from its Irish holding company, which is distinct from its local national subsidiaries – even though they are all part of the same multinational group. Their reporting compliance and tax liabilities are,…

-

Book review: Global Tax Governance – What is wrong with it and how to fix it

One of the major 21st century challenges for politicians and polities at both the national, regional and international levels is the governance of ever-more global, mobile and flexible economic and financial flows. No more so than in the area of taxation, which looks likely to remain the last bastion of entrenched perceptions of national sovereignty, an undisputed cornerstone…

-

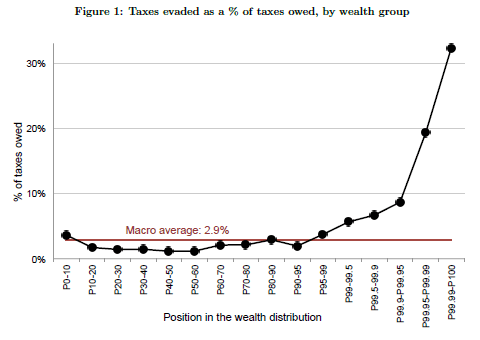

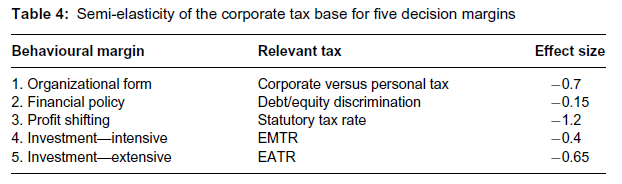

We’re changing the equation of tax competition and corporate profit shifting

Within tax economics, one of the central arguments for tax competition and low(er) taxes on capital, including corporate profits, is that it leads to increased investment and growth (at least in some countries, mostly small open economies). Why? In short, we know that corporate tax rates and rate changes have behavioural effects. Capital income may…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.