-

The Show Must Go On

The US and Europe are locked in a dispute over how to tax Big Tech. Can the OECD’s ambitious global tax treaty resolve the issue, or will it sink like the Titanic? In this blog post, I discuss the history of the dispute, and the challenges and prospects of the complex negotiations.

-

UN-doing the OECD’s global tax dominance?

For a couple of decades now, debates over the which international organisation should be in charge of organising global tax policy-making have ebbed and flowed, every once in a while heating up and surfacing in global political discussions, then fading back into isolated debates amongst selected tax stakeholders. The classic dichotomy is one where the…

-

Academic Political Scientists on International Taxation – OECD Digital Consultation Letter

A group of political science academics working on issues of international taxation have submitted a joint response to the OECD’s Public Consultation Document on ‘Addressing the Challenges of the Digitalisation of the Economy’. The full letter can be found here.

-

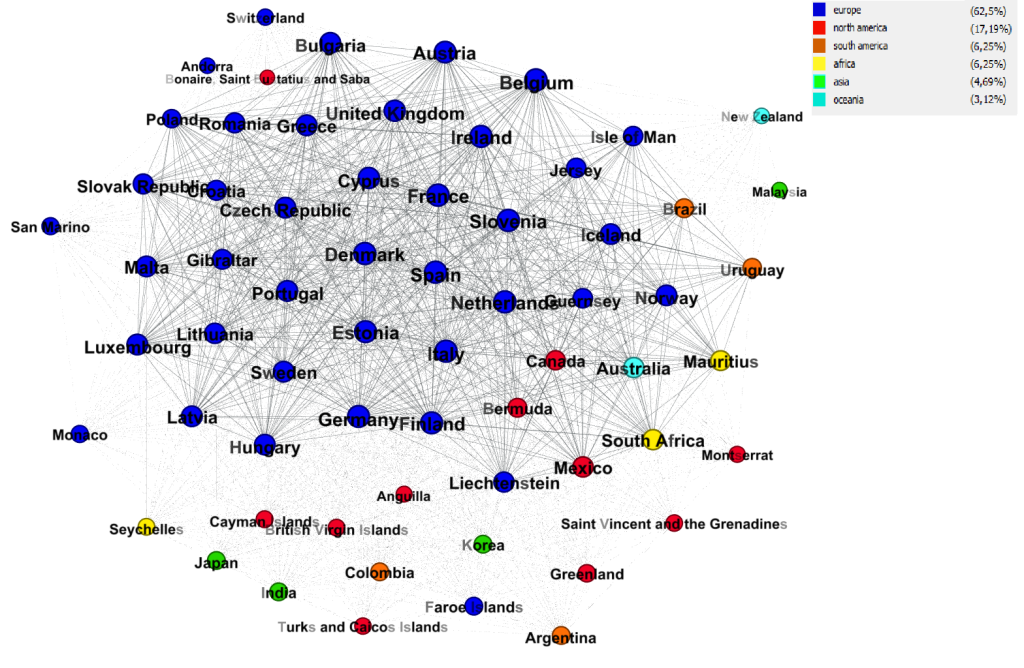

The new political economy and geography of global tax information exchange

The OECD has recently released information on the two most important recent global networks of global tax information exchange. They are, respectively, the networks of exchange of country-by-country reporting (CBCR) and exchange of financial account information (through the Common Reporting Standard, CRS). These networks give a unique look into the new political economy and geography of…

-

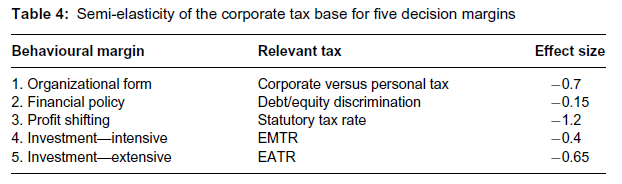

We’re changing the equation of tax competition and corporate profit shifting

Within tax economics, one of the central arguments for tax competition and low(er) taxes on capital, including corporate profits, is that it leads to increased investment and growth (at least in some countries, mostly small open economies). Why? In short, we know that corporate tax rates and rate changes have behavioural effects. Capital income may…

-

The bark IS the bite, but ..: Why tax haven blacklists are not the answer

The OECD has been working on criteria for a tax haven blacklist. At the request of the G20 Finance Ministers, this has been a work in progress since April of this year. And the results are set to be presented at the G20 finance minister’s meeting in China next month. This morning, the FT reports that…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.