-

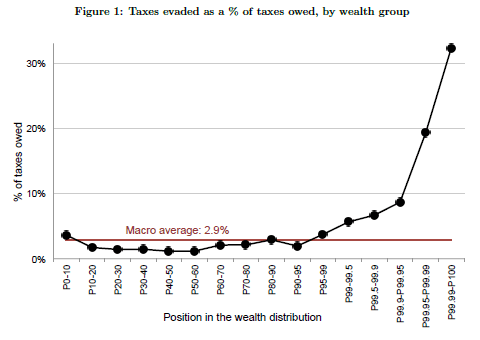

Why do people evade taxes?

-

We’re changing the equation of tax competition and corporate profit shifting

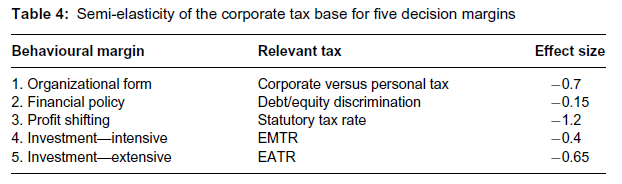

Within tax economics, one of the central arguments for tax competition and low(er) taxes on capital, including corporate profits, is that it leads to increased investment and growth (at least in some countries, mostly small open economies). Why? In short, we know that corporate tax rates and rate changes have behavioural effects. Capital income may…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.