-

The Show Must Go On

The US and Europe are locked in a dispute over how to tax Big Tech. Can the OECD’s ambitious global tax treaty resolve the issue, or will it sink like the Titanic? In this blog post, I discuss the history of the dispute, and the challenges and prospects of the complex negotiations.

-

A Little Rule with Big Impact

Exploring the unexpected ‘canary in the coal mine’ of international taxation: the undertaxed profits rule. This small part of the global minimum tax agreement could revolutionize tax and sovereignty in surprising ways.

-

UN-doing the OECD’s global tax dominance?

For a couple of decades now, debates over the which international organisation should be in charge of organising global tax policy-making have ebbed and flowed, every once in a while heating up and surfacing in global political discussions, then fading back into isolated debates amongst selected tax stakeholders. The classic dichotomy is one where the…

-

Ain’t nothin’ but a G7 thang

This weekend, the Group of Seven (G7) finance ministers completed a “historic deal”, a new “global tax agreement” that will truly bring the international tax system “into the 21st century”. Or so, at least, is the narrative presented by some of the G7 folk (most prominently UK chancellor Rishi Sunak), which has been swallowed by…

-

The Paradise Papers should lead us towards a new global tax system

Last week, I published an op-ed in Danish newspaper Politiken with my colleague Saila Stausholm. I reproduce it below, liberally translated, for those interested. Given the op-ed format, it naturally has certain limitations and a certain style that differs from my usual writings on this blog – so take that into account. Here we go: The Paradise…

-

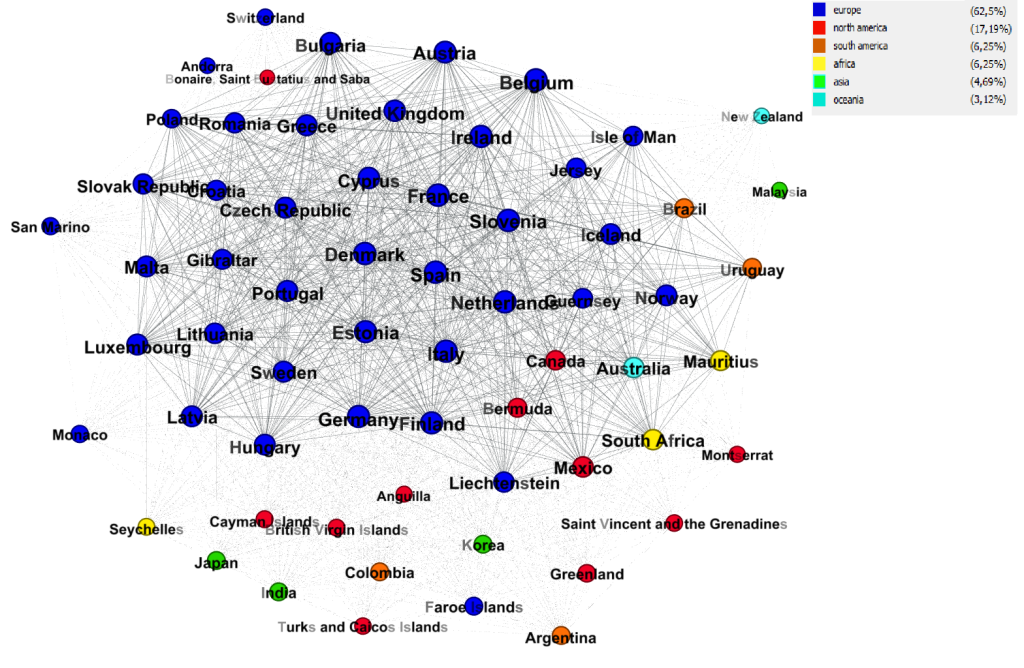

The new political economy and geography of global tax information exchange

The OECD has recently released information on the two most important recent global networks of global tax information exchange. They are, respectively, the networks of exchange of country-by-country reporting (CBCR) and exchange of financial account information (through the Common Reporting Standard, CRS). These networks give a unique look into the new political economy and geography of…

-

Book review: Global Tax Governance – What is wrong with it and how to fix it

One of the major 21st century challenges for politicians and polities at both the national, regional and international levels is the governance of ever-more global, mobile and flexible economic and financial flows. No more so than in the area of taxation, which looks likely to remain the last bastion of entrenched perceptions of national sovereignty, an undisputed cornerstone…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.